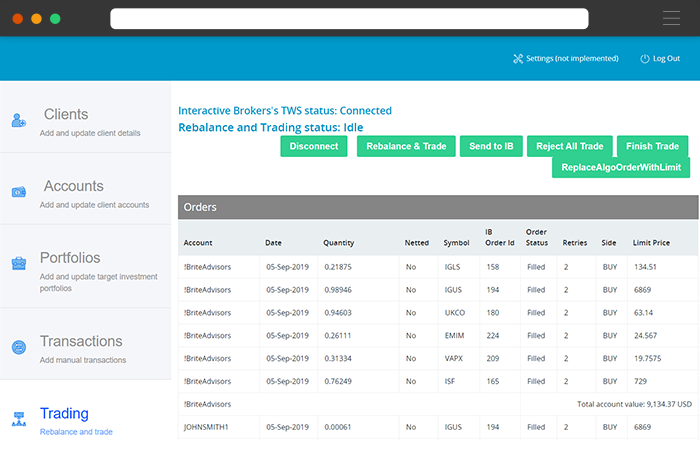

A trader has full transparency of an exchange’s order book and all of its trade orders. Direct market access platforms can be integrated with sophisticated algorithmic trading strategies which can streamline the trading process for greater efficiency and cost savings. Direct market access allows buy side firms to often execute trades with lower costs. Since it is all electronic, there is less chance of trading errors. Order execution is extremely fast, so traders are better able to take advantage of very short-lived trading opportunities

Technical Features

- CI/CD enabled

- Full Test coverage

- Easy customization

- Modular design facilitating robust and scalable order routing and trade management with multiple external entities

We support integrations with following exchanges

NYSE, NASDAQ, CME/CBOE, TYO, ASX, SIX Swiss Exchange, JSE, HKEX, LSE, Borsa Istnabul, NSE, BSE, TSX, IEX, Shanghai Stock Exchange, ICE Future, OSE, Canadian Securities Exchange, Borsa Italiana, Philippine Stock Exchange, Egyptian Exchange, Amman Stock Exchange, NYSE Arca, Frankfurt Stock Exchange

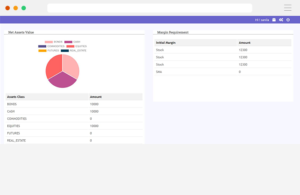

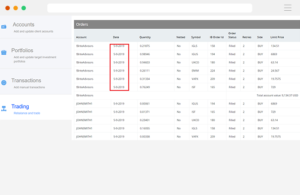

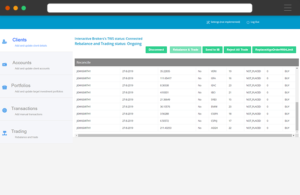

Some more images

What they said

We’re humbled to be working with such a great variety of clients that range from early stage startups to Fortune 500 companies.

“Honored to work with Bhavishya! One of the best!”

John Huges

“Magnificent talent. Know-how of FIX is phenomenal. Great communication and especially cooperative whenever we needed extra help with concepts or comprehension. Especially enjoy his broad analytical mind and the comprehensive nature of the solutions or architecture decisions.”

Rahim

DataSoft CTO

“Bhavishya Goyal delivered a great job for our auto-trading bot and I enjoyed working with him. His communication was on point, all deadlines were on time, and his skills were reasonably strong. He helped me find additional freelancers to support the work. It was a pleasure working with Bhavishya Goyal and have jobs for him in the future.”

Ryan

Assit A Boss

“Was a great experience to work with Bhavishya! Very fast answers and support for everything, almost around the clock 🙂”

Manuel Drechsler

We are optimists who love to work together

Let’s collaborate and make an impact with our cross-discipline approach to design and deveopment.